Review of Bidder Capacity to Meet Projected Beneficiary Demand Fact Sheet

On April 9, 2020, the non-invasive ventilators product category was removed from Round 2021 due to the novel COVID-19 pandemic. On October 27, 2020, the Centers for Medicare & Medicaid Services (CMS) announced the single payment amounts (SPAs) and began offering contracts for the off-the-shelf (OTS) back braces and OTS knee braces product categories. All other product categories were removed from Round 2021. Please see the CMS announcement for additional information.

The Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) Competitive Bidding Program’s bid evaluation process is designed to award contracts to bidders to furnish quality items and services to beneficiaries throughout the competitive bidding areas (CBAs) at competitive payment amounts during the contract period of performance. In accordance with 42 CFR §414.414(e), CMS accomplishes this important objective by establishing projected beneficiary demand in each CBA and then awarding a sufficient number of contracts to meet beneficiary demand for each CBA and product category combination (competition).

Bidding and Supplier Eligibility

Suppliers bidding in the DMEPOS Competitive Bidding Program must provide their estimated capacity for the lead item in each product category for which they bid. Please refer to the Lead Item Pricing fact sheet and the Bid Preparation Worksheets for guidance on determining estimated capacity and bid amounts.

Prior to reviewing a bidder’s estimated capacity, CMS begins the bid evaluation process by verifying bidder eligibility requirements. All bidders are evaluated for compliance with enrollment standards (i.e., Provider Transaction Access Number (PTAN) status, state licensing requirements, accreditation), common ownership and common control, financial standards, bid surety bond requirements, and other competitive bidding program requirements.

Calculate Projected Beneficiary Demand

The methodology for projecting beneficiary demand for items and services in each competition (42 CFR §414.414(e)(1)) accounts for actual historic beneficiary utilization of the lead item in the product category over the previous two year period (i.e., two-year average of 2017 and 20181), while also considering the expected growth in the number of beneficiaries enrolled in Medicare in the CBA as well as the expected growth in utilization of the lead item in the product category in the CBA. (CMS has historically provided only the most recent calendar year of the allowed units and the beneficiary count, but, starting with Round 2021, CMS is providing the two most recent years of the allowed units and the beneficiary count for all lead and non-lead items in the Utilization Report.)

Specifically, CMS calculates the projected beneficiary demand for the lead item by multiplying the actual historic beneficiary utilization by a percent increase that is derived from increasing historic utilization by both the expected increase in number of beneficiaries and the expected increase in utilization, in general. If either the change in number of beneficiaries or the change in utilization in the CBA is expected to be negative, the negative trend is not included in the projection of demand and is instead set equal to one. CMS does not project beneficiary demand to be less than the two-year average of historic utilization, even if actual demand may be decreasing in an area. (New for Round 2021, CMS is providing the two-year average of allowed units and the percent increase for each lead item in each CBA in the Bid Preparation Worksheets.)

In addition, the projected beneficiary demand is not reduced based on the number of items that would likely be furnished by grandfathered suppliers, who typically furnish approximately 15 percent of rented durable medical equipment items and related accessories. This method helps to ensure that a sufficient number of contract suppliers is available to meet actual beneficiary demand for all lead and non-lead items and services throughout the contract period of performance. (Also new for Round 2021, CMS is providing the projected beneficiary demand for the lead item in each CBA in the Bid Preparation Worksheets.)

Determine Bidders’ Capacity to Meet Projected Beneficiary Demand

After determining the projected beneficiary demand, CMS calculates how many contract suppliers are needed for each competition to meet beneficiary demand throughout the contract period of performance using a two-step approach.

Step 1: The first step analyzes each qualified bidder’s financial health to assess its ability to furnish its estimated capacity against the projected beneficiary demand in each competition.

- If a bidder’s financial score2 meets the minimum financial threshold required by CMS for a bidder to receive additional capacity beyond its historical amount, CMS accepts the bidder’s capacity at the greater of its estimated or historical capacity (based on claims data). However, if a bidder’s financial score does not meet this threshold, the bidder is a new supplier (does not have 12 months of actual financial statements and submits at least one month of pro forma statements), or the bidder is a specialty supplier, CMS only accepts its capacity at its historical amount.

- If a bidder’s accepted capacity is greater than 20 percent of projected beneficiary demand in the CBA, CMS adjusts the bidder’s capacity to 20 percent of projected beneficiary demand to ensure at least five contracts are awarded for each competition, in accordance with 42 CFR §414.414(h).

CMS sets the pivotal bid at the point where the bidders’ accepted combined capacity meets the projected demand for the competition (42 CFR § 414.414(e)(2)). All bidders whose lead item bid amounts are at or below the pivotal bid (and who meet the supplier eligibility requirements specified in the regulations and the Request for Bids Instructions) will be selected as winning suppliers for the competition.

The SPAs that result from Step 1 are considered preliminary SPAs until the completion of Step 2 (below).

Step 2: CMS performs an additional analysis to ensure demand will be met if some bidders, who are planning to expand, need time to ramp up to their estimated capacity. This second step uses the most recent 12 months of claims data that was not available when Step 1 was performed. Using this data allows CMS to account for any unforeseen increases in utilization as almost a year has passed since the original calculation of the projected beneficiary demand.

Step 2 also further scrutinizes bidders’ capacity to confirm that they are capable of furnishing items at levels exceeding their historical capacity in the competition prior to calculating the final SPAs. (New for Round 2021, CMS is no longer requesting bidders to submit expansion plans as part of this process (83 Fed. Reg. 57052 (November 14, 2018))). This is performed by separating bidders into three groups that factor in each bidder’s financial health, experience furnishing the lead item, and ramp-up revenue percentage3.

Group 1:

- Meets the minimum financial threshold required by CMS for a bidder to receive additional capacity beyond its historical amount; and

- Has experience furnishing the lead item in the CBA; and

- Has sufficient ramp-up revenue.

CMS accepts the higher of the estimated or historical capacity for Group 1 bidders.

Group 2:

- Meets the minimum financial threshold required by CMS for a bidder to receive additional capacity beyond its historical amount; and

- Does not have experience furnishing the lead item in the CBA, but has experience furnishing the lead item in other CBAs for which the bidder has submitted a bid; and

- Has sufficient ramp-up revenue.

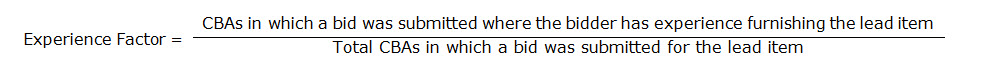

CMS uses the following experience factor to determine the capacity for Group 2 bidders:

Group 2 bidders will have their capacity adjusted by multiplying the bidder’s estimated capacity, in each of the competitions where they do not have experience, by the experience factor. For example, if a bidder submitted 10 bids for enteral nutrition and only had experience in half of those competitions, the bidder would have its estimated capacity lowered by 50 percent for the competitions where it does not have experience.

Group 3:

- Does not meet the minimum financial threshold required by CMS for a bidder to receive additional capacity beyond its historical amount; or

- Is a new supplier or a specialty supplier; or

- Does not have experience furnishing the lead item in any CBA for which the bidder has submitted a bid; or

- Does not have sufficient ramp-up revenue

CMS accepts the historical capacity for Group 3 bidders, which is zero for bidders with no experience furnishing the lead item.

It is important to note that Step 2 of CMS’ analysis is only used as a method for offering additional contracts and will not remove any bidders from the initial winning array (i.e., bidders whose bids were at or below the pivotal bid). That is, CMS will never lower the pivotal bid amount set during the initial capacity analysis, even if the Step 2 analysis determines that beneficiary demand can be met with fewer suppliers. As a result, Step 2 removes the 20 percent of projected beneficiary demand limit (explained in the second bullet in step 1 above) since we have already ensured in Step 1 that at least five contracts are awarded for each competition (42 CFR §414.414(h)).

If Step 2 determines that no additional bidders are needed to meet beneficiary demand, the preliminary SPAs established in Step 1 are set as the final SPAs for the competition as explained in the next section below. However, if Step 2 determines that additional bidders are needed to meet beneficiary demand, CMS continues through the array (bidders who are eligible for a contract offer are arranged by lowest to highest lead item bid amount) until bidder capacity meets or exceeds beneficiary demand for the competition. Once CMS adds enough bidders to where the cumulative accepted capacity of the bidders selected in the array meets beneficiary demand, the pivotal bid is increased accordingly and the resulting SPAs are set as the final SPAs for the competition.

Calculating SPAs and Identifying Bidders to be Offered Contracts

Once the pivotal bid and selection of winning suppliers are finalized, the SPA is then set based off the maximum winning bid for the lead item and calculated for all non-lead items in accordance with 42 CFR §414.416(b). CMS then determines which percentage of bidders in the winning array of bids are small suppliers. If less than 30 percent, CMS will offer a contract to the next eligible small supplier(s) until the 30 percent small supplier target is reached or there are no more qualified small suppliers for the competition (42 CFR §414.414(g)). Bidders may also be added, if necessary, when a contract offer is declined or when a bid disqualification is overturned. It is important to note that SPAs are not recalculated when a bidder is added to meet the 30 percent small supplier target, when a contract offer is declined, or when a bid disqualification is overturned and a contract offer is subsequently made to a bidder (72 Fed. Reg. 18044 (April 10, 2007)).

___________________

1 The significant increase of allowed units for the off-the-shelf (OTS) back brace lead item from 2015 through 2018 is a data anomaly which CMS believes is attributed to fraud, waste, and abuse. To avoid unreliable data, CMS is using the two-year average of 2014-2015 allowed units as a proxy, instead of 2017-2018, for the purpose of projecting beneficiary demand for OTS back braces.

2 CMS uses the required tax return extract and the required financial documents to calculate standard accounting ratios for each bidder. These ratios, along with the credit report and numerical credit score or rating, are used to compute the bidder’s financial score. The methodology for computing bidders’ financial scores has remained consistent throughout all rounds of the DMEPOS Competitive Bidding Program.

3 Ramp-up revenue is determined by multiplying a bidder’s projected growth (i.e., taking the bidder's estimated capacity minus its historical capacity) by the preliminary SPA for the lead item. To determine if a bidder has sufficient ramp-up revenue to support its estimated capacity, its ramp-up revenue is divided by the bidder’s actual revenue to produce a percentage. The purpose of this process is to act as a safeguard to ensure bidders are not over-estimating their ability to expand.

DMEPOS CBP Web Chat

Updated: 10/27/2020